4 Ways to Get Capital for Your Textbook Reselling Biz (Step-by-Step)

Welcome back, Anon.

I grew up in a house of Ramsey Budgetoors and always struggled rationalizing financial risk to reward. It wasn’t until my late 20’s that I started to realize that saving 15% of your savings (Ramsey’s Rule) was not enough to retire before 65 years old.

Once I found the jungle, I was hesitent to start any business due to the loss I could face and muh opportunity cost of not investing that into the market (e.g., iF yOu sKip A a CofFeE eVerYdaY aNd InVeST foR 25 YeArs YoU’lL haVe $325,000 wHen YoUR 65).

Evenutally though, I realized that my retirement investment isn’t enough, generating extra income is necessary.

With that, starting any kind of business requires a bit of captial to test and see if it’s going to work. Books aside, you need money to test ads, to buy equipment, and to even get courses. I figured I’d lay out the steps I’d take, if I was starting over again, to financing a new business venture (and I’ll use this method again in the future).

There’s no crazy alfa here, just an amalgamation of what I’ve digesed over the last few months. Here are the 4 steps I will take to generate the money to test my next business:

Note: before performing the following steps, have a tentative plan in place for how you’re going to use the money (e.g., I’m going to buy a pressure washer and create flyers or I’m going to start an affiliate marketing business).

1. Open a Checking Account

The first step I will take is opening a checking account but not just any checking account. I’ll head over to doctorofcredit.com and find a checking (personal or business) that’s paying a sign-up bonus over $400.

For anyone who hasn’t been on this site before, it’s a blog that captures all of the sign-up bonuses going on, both nationally and within each state. The site lists the criteria for getting the sign-up bonus and includes a comment section below where people talk about their experience.

Typically for a sign-up bonus of $400, I’ll put some direct deposit money in from my W-2 and hit the bonus ASAP.

Here’s a few examples:

https://www.truist.com/small-business/banking/checking-offer

https://broadway.bank/landing-pages/500

This account will also serve another role. After I’ve received the bonus, I’ll set the account up for my new business. I’ll create a few sub accounts for things like inventory and a small reserve.

Now, my checking account has served two purposes: given me some capital to work with and helped organize the finances for my new business.

Total Starting Capital after a Checking Account: $400

2. Open a Credit Card

After I open up the checking account, I’ll head to doctorofcredit.com and the BowTiedBum Substack to see what credit card deals are giving the best sign-up bonus. Since we’re starting a sole prop, we can apply for a personal or business card, depending on our current financial picture.

I’d look to get a card that gives at least a $750 sign-up bonus (e.g., Chase Ink Cash or American Express Business Gold).

Once I’ve found the card I want, I’ll read the T&C to confirm that I am able to spend what the sign-up bonus requires. I personally don’t have a high monthly spend, so I’ll have to explore other avenues to generate the required spend, like a buy group.

Here are a few examples:

https://www.doctorofcredit.com/chase-ink-preferred-100000-points-offer-with-lower-8000-spend-requirement/

https://www.doctorofcredit.com/american-express-business-platinum-150000-points-bonus-15k-spend/

For anyone who’s hesitant, it’s not a big deal spending $10k+/mo on a credit card…

I won’t go too much more in-depth on this section; for more info from the master, check out BowTiedBum.

Once I hit the sign-up bonus, I now have a card that I can use for my new business and additional capital to throw at the investment. I personally like to keep all my spend for textbook reselling on one card; that way I know exactly how much I’ve spent and easily gauge my expenses.

Total Starting Capital after a Checking Account and Credit Card: $1,150

Sell a couple items

I almost did not include this section because it seems like a catch all for any furu on the internet.

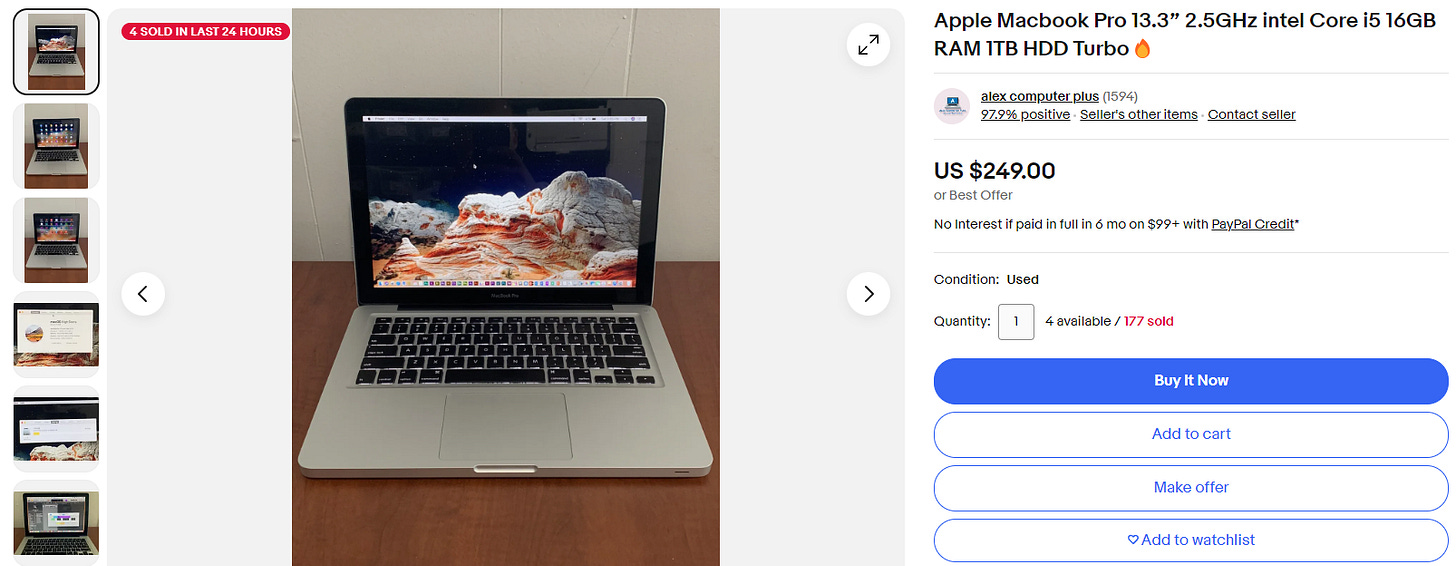

However, after taking this seriously and seeing what I could sell, I was shocked at how much extra stuff I had. I live by myself in a 700 sq. ft. apartment and was able to find $400+ worth of things to sell on eBay…

I can’t emphasize this enough.

If you’re skeptical and claim to having nothing to sell, I challenge you to spend 20 minutes looking around your house. I gaurantee you’ll find a couple hundred dollars worth of goods.

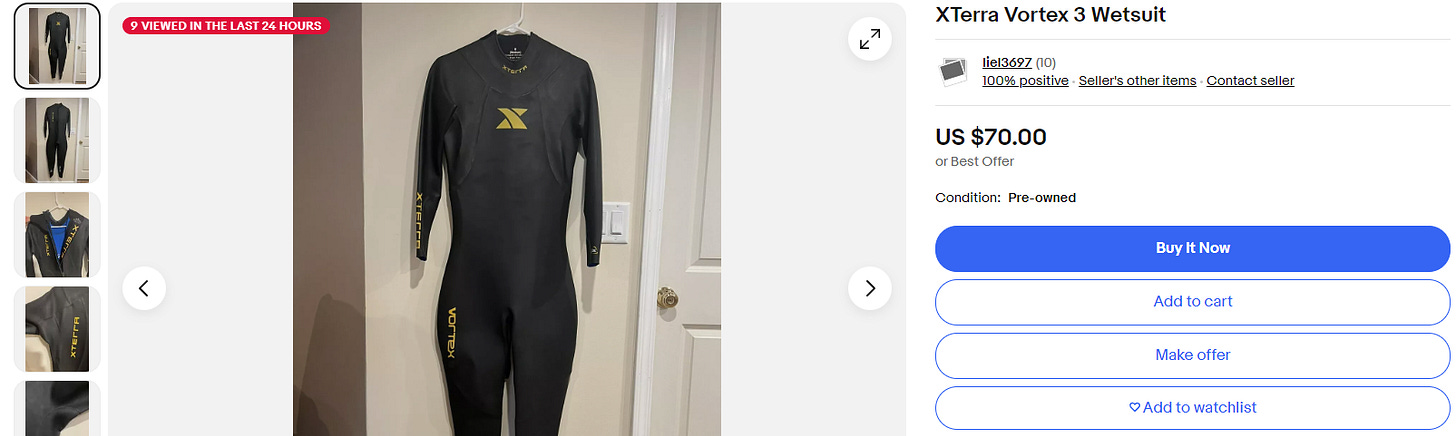

I sold a couple old iPhones, a wet suit, and a watch on eBay.

In addition to getting some extra cash for the new business, setting up eBay listings helps get in the swing of interacting with people on eBay. For my book reselling business, I use eBay daily to look for goods to purchase.

So, learning how to list and interact with others on the eBay marketplace is a good experience that’ll help.

Total Starting Capital after a Checking Account, Credit Card, and eBay sales: $1,550

Gig Work

The last activity we’ll use to generate starting capital for our business is doing some gig work.

I’ll leave this section open and do some basic math to support my claim.

If you have a car, I’d suggest doing Uber over any other time-for-money gig given the flexibility and lack of committment in the long run.

The results are mixed and the gig work you choose might be different, so I’ll put a conservative estime in that you’ll generate $25/hr and work ~18 hours over the next three months (while you wait for your credit card and bank SUBs to hit): $450

Source for income estimate:

I don’t want to spend too much on this section because you get the idea; do some time-for-money gig a few hours per month so that you can plow into your real business.

Total Starting Capital after a Checking Account, Credit Card, eBay sales, and Gig Work: $2,000

Conclusion

There you have my step-by-step process to generating capital to have a “free” shot of starting a new business. For anyone who’s hesitent to start something, there really are no excuses in 2024.

Now, will $2,000 start the next Amazon?

No.

Will it start a lot of other small businesses with potential to scale?

100%.

From a textbook reseller perspective, you could buy ~75 books (assuming avg. price of $20) and have a good idea if it’s something you want to stick with. If, after a couple of months, you don’t see value in continuing, you’re out no money.

I’m at a point now in my career where I can take larger shots than this using savings from my W-2, but trying new things out online (tweethunter, Keepa, etc.) is always easier for me when I feel like it’s “free.”

Need help getting started?

Guide to Reselling College Textbooks - Step-by-step process to starting your college textbook reselling business from the equipment needed to generating your first sale

Book List - I’ve created a list of 1,000 College Textbook ISBNs for you to use to get started setting alerts in Keepa